An Ad Valorem Tax Causes the Supply Curve to:

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Shift to the right.

Direct Indirect Taxes As A Levels Ib Ial The Tutor Academy

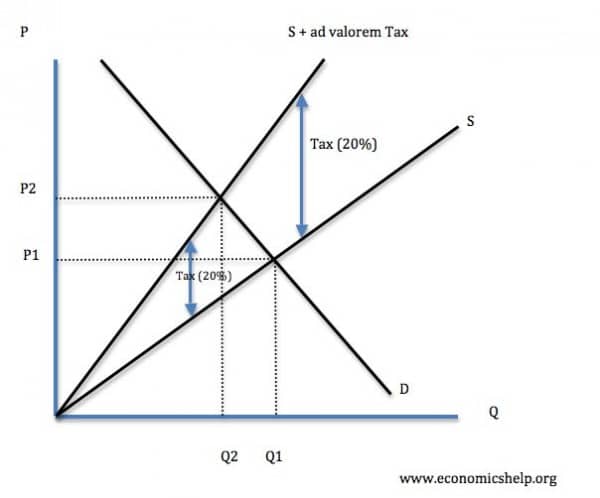

An ad-valorem tax always causes a pivotal rotation of the supply curve to the left as shown below.

. An ad valorem tax causes supply curve to. Technological advances will cause the supply curve to. Thus in case of an ad valorem tax firms begin to leave the industry.

Diagram of ad valorem tax. An ad valorem tax is a percentage tax imposed on a commodity at the time of sales. The amount of tax depends on the price.

Shift to the right. An ad valorem tax is a percentage tax imposed on a commodity at the time of sales. How many units of good X are.

Ad Valorem causes a non-parallel shift of the supply curve. O price D P 1 KL R P 2 S output. The tax burden of producers will also increase.

A tax shifts the supply curve to the left. D Some consumers can avoid paying indirect tax. Shift to the right.

Shift to the left. Ad Valorem causes a non-parallel shift of the supply curve. The most common ad valorem taxes are property taxes levied on real estate.

An ad valorem tax causes supply curve to. Figure 32 - The effect of ad valorem tax on the supply curve. Whole Tax 18 7 x 10 11 x 10 110.

We shall assume here that the tax is collected from the buyers rather than from the sellers. B False. An example of an ad valorem tax is VAT which is 20 in the UK.

It is important to remember though that taxes finance government spending which also contributes to the position of the demand curve. Technological advances will cause the supply curve to. Tax wedge is the difference between tax induced price paid by customer and the tax amount ATrue.

The converse is also true. When the supply curve finally shifts to S 1 the competitive industry reaches. An ad valorem tax is a value-based tax.

A price ceiling of 3 will result in a A shortage of 30 units. Let us suppose that the demand curve for a good is DD in Fig. It is a value based tax.

If an ad valorem tax is imposed the gap between the two supply curves will be wider as Fig. C surplus of 30 units. A A progressive tax usually improves the distribution of income.

Multiple Choice shift to the right. An ad valorem tax causes the supply curve to. Multiple Choice shift to the right.

For this will make our task of explaining the effects of the tax easier. For example if we take VAT. Shift to the left.

Producer Tax 10 7 x 10 3 x 10 30. This means at lower prices the tax amount is less and at higher price there will be more tax. It is imposed in percentage terms and therefore higher the value of the goods higher is the ad valorem taxThe progressivity of a View the full answer.

B shortage of 15 units. Calculating the tax area. As the consumption of the commodity increases the tax burden of consumer will also increase.

A shift to the right. In the supply and demand curves unit taxes cause shifts. 1 In a competitive market the market demand is Q d 60 - 6P and the market supply is Q s 4P.

The quantity of tax is dependent upon the value of the good being bought. Chapter 2 Sample MULTIPLE CHOICE - Choose the one alternative that best completes the statement or answers the question. An ad valorem tax The imposition of an ad valorem tax will shift up the supply curve by a certain percentage meaning that the new supply curve will not be parallel to the original.

It is sometimes called a sales tax. C An ad valorem tax causes a parallel shift left of the supply curve. Technological advances will cause the supply curve to.

A tax on buyers is thought to shift the demand curve to the leftreduce consumer demandbecause the price of goods relative to their value to consumers has gone up. Suppose the supply of good X is given by QS x 10 2P x. D shift to the left.

Shift to the left. Shift to the left. A specific unit tax will shift up the supply curve by the full amount of the tax so that the new curve is parallel to the original one as shown.

18 The diagram shows the market supply and demand curves for wheat. When government spending increases so. This is because ad valorem tax is always the same percentage of the price therefore higher prices cause a steaper curve.

Economic profits are defined as the difference between the revenues and accounting costs. As firms continue to leave the industry the industry supply curve shifts to the left. Thus an advalorem tax leads to greater loss of social welfare.

Regardless of the non-parrallel shift the burden of tax on the consumer and producer is calculated in exactly the same way as a specific tax. The ad valorem tax causes a pivoted inward shift in supply and not a direct inward shift as shown below. Consumer Tax 18 10 x 10 8 x 10 80.

An ad valorem tax is levied as a percentage of the goods. An ad valorem tax causes supply curve to. It is imposed as a fixed percentage of the price of a commodity.

An ad valorem tax The imposition of an ad valorem tax will shift up the supply curve by a certain percentage meaning that the new supply curve will not be. D surplus of 12 units. Since the effect of this tax is on.

This means that existing firms are incurring losses. B A regressive tax benefits the rich more than the poor.

Direct Indirect Taxes As A Levels Ib Ial The Tutor Academy

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

No comments for "An Ad Valorem Tax Causes the Supply Curve to:"

Post a Comment